Quarterly Talks with Ted

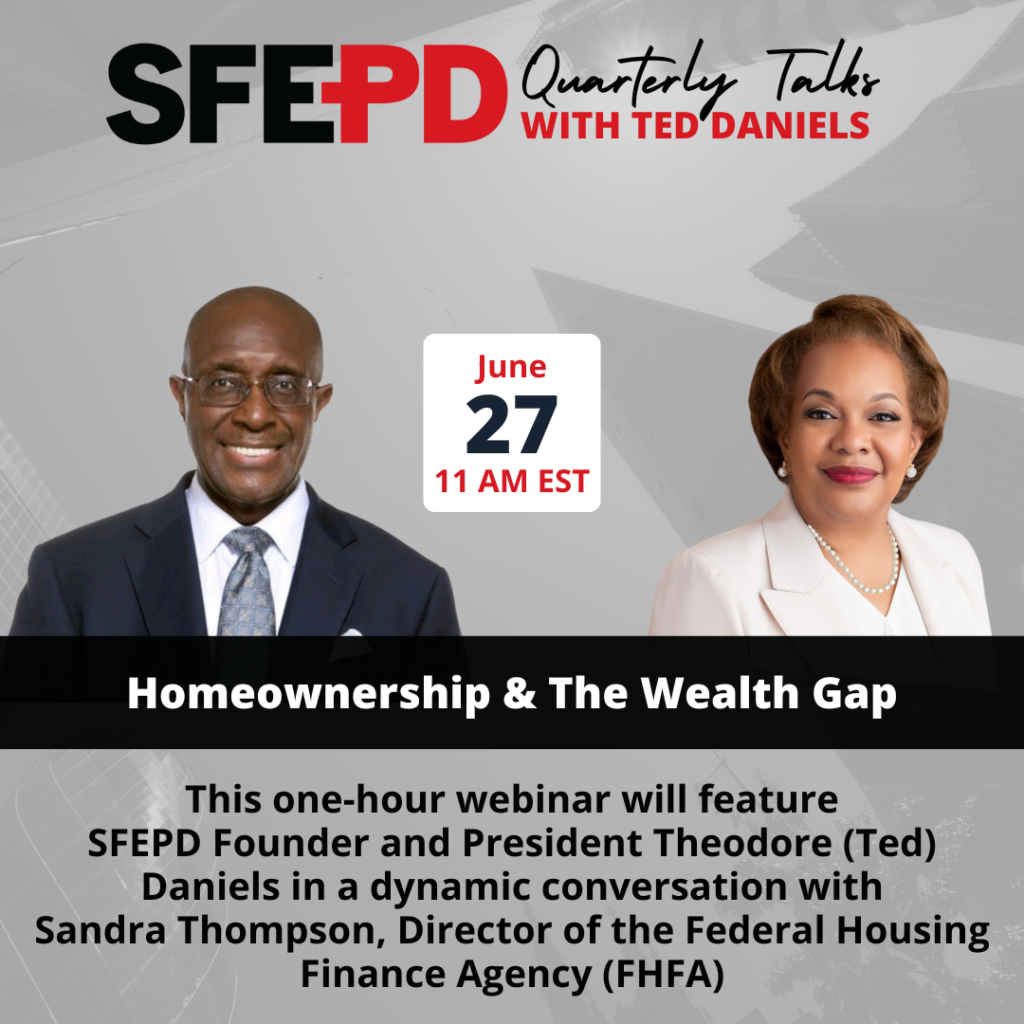

| CALENDAR | TOPIC | SPECIAL GUEST(S) |

| 28-Mar-24 | Diversity in the Asset Management Industry | Eric Pan, President and Chief Executive Officer of the Investment Company Institute (ICI) |

| 7-Dec-23 | Medicare & Credit | Rod Griffin, Senior Director of Consumer Education and Advocacy for Experian |

| 28-Sep-23 | Diversity, Equity & Inclusion in the Financial Markets | Jaime Lizárraga, SEC Commissioner |

| 29-Jun-23 | The Cost of Financial Illiteracy | Vince Shorb, Founder & CEO, National Financial Educators Council |

| 20-Mar-23 | Financial Security: Today & Tomorrow | Angela Antonelli, Research Professor and Executive Director, Center for Retirement Initiatives, Georgetown University’s McCourt School of Public Policy Kendra Kosko Isaacson, Pensions Policy Director and Senior Tax Counsel for Senator Patty Murray. |

| 1-Dec-22 | The Impact of Financial Literacy | Dr. Beth Bean, Senior Vice President, Research and Impact, National Endowment for Financial Education (NEFE) Tim Ranzetta, Co-Founder of Next Gen Personal Finance |

| 29-Sep-22 | HBCUs Leading the Way to Economic Well-Being | Duwain Pinder, Partner, McKinsey & Company Darrell K. Williams, President, Hampton University |

| 30-Jun-22 | Economic Equity | Dr. William Rodgers, Vice President and Director, Federal Reserve Bank of St. Louis Dr. Jacqueline Scott, Associate Professor of Philosophy, Loyola University Chicago |

| 31-Mar-22 | Black Women and Investing | Nekia Hackworth Jones, Director, SEC Atlanta Regional Office |

Click on the topic to watch the replay on YouTube.